On the day, at 2:09 pm the US dollar was down 0.29%, trading at R$ 5.0464. At the maximum it hit R$ 5.0845 – highest nominal price

This Tuesday (17), the commercial dollar, which is the reference in transactions between companies and banks, closed with a drop of 0.9% and ended the day with a quotation of 5.002 reais. The tourist dollar closed at 5.20 reais, down 0.4%.

After the Federal Reserve announced that, as an emergency, it would buy debt directly from companies to ease the credit markets, something that had not happened since 2008. The devaluation of the US currency reflected greater optimism in the market

Central Bank and dollar

Central Bank interventions also helped to hold the currency. In the morning, the BC held an auction of a line of 2 billion dollars.

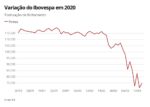

In the morning also after the first confirmation of death in Brazil because of the coronavirus. The dollar reached its all-time high when trading at 5.078 reais. Cristiane Quartaroli, exchange rate strategist at Banco Ourinvest, believes that the spread of the disease in the country could have negative impacts on the exchange rate. “We will continue in a scenario of high volatility, very heavy,” she said.

Selic Interest Rate

The market is also awaiting the decision of the Monetary Policy Committee of the Central Bank of Brazil (Copom) on the Selic basic interest rate. The regular two-day Copom meeting started on this Tuesday.

After the Federal Reserve (Fed), central bank of the United States, announced by surprise the reduction of its interest rate to zero on Sunday (15) night to try to neutralize the negative effects of the pandemic of coronavirus, the Brazilian Central Bank has under pressure to take the same action.

The effect of a reduction in the Selic rate in the exchange market would make the dollar appreciate more against the real. Therefore, international investors who invest in fixed income in the country could withdraw their resources from Brazil to place them in nations perceived as safer. There is a great debate among economic specialists about how effective a Selic cut is at the moment for the Brazilian economy. The rate is at 4.25% per annum, the lowest historical level.

“The best thing would be not to cut back to attract foreign capital and take the pressure off the dollar without the Central Bank having to act. If cut, dollar at 5 reais will be the new normal”, says Jefferson Laatus, chief strategist of Grupo Laatus.